Cryptocurrency, Bitcoin, Ethereum Capital Gains Tax Secrets

Original Price: $N/A

DOWNLOAD: FREE FOR MEMBERSHIP (CLICK HERE)

Author: N/A

Sale Page :_N/A

Contact me for the proof and payment detail: email_Ebusinesstores@gmail.com Or Skype_Macbus87

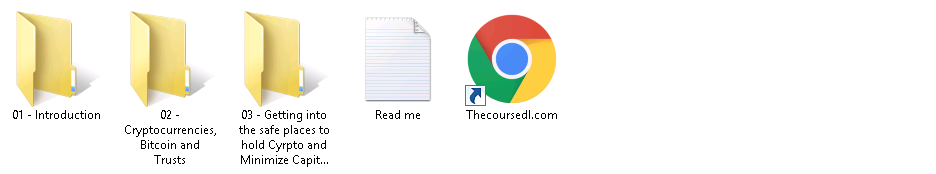

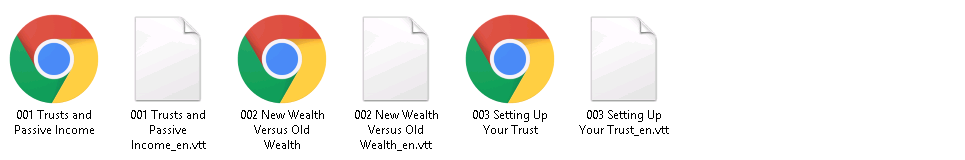

PROOF COURSE:

What you’ll learn

How Capital Gains Taxes affect your Cryptocurrency profits

How to defer capital gains taxes legally

What the best business vehicle to purchase and trade Bitcoin, Ethereum and other coins in is

What the ORS did to track down tax cheaters in crypto

Requirements

Made huge profits in BitCoin, Ethereum and other cryptocurrencies

Description

Crypto-millionaires have seen massive increases in the value of their cryptocurrencies, like BitCoin, Ethereum, Dogecoin, and many others. When they want to cash out their crypto, they face huge capital gains. And not only that, the US government is looking at taxing Capital Gains in the year they occurred instead of when the Capital Gains is realized. This could be a huge problem for crypto investors.

There is a coming storm in the world of finance as governments around the world engage in a global contest to digitize their currencies.

And how they deal with the huge growth in prices for crypto, will affect where crypto-millionaires end up living, and how they respond to these draconian tax changes.

Microsoft CEO Satya Nadella sold about half of his shares in the company last week, according to a federal securities filing, ahead of a change in the way the shares will be taxed.

The Wall Street Journal reported that the sale could be related to Washington state instituting a 7% tax for long-term capital gains beginning at the start of next year for anything exceeding $250,000 a year.

If Nadella had taken this course, he would know strategies that would give him different options and protect his wealth.

Digital currency or cryptocurrency has occupied a large part of social media platforms in recent years.

Technological change is upending finance.

Bitcoin has gone from being an obsession of anarchists to a $1,000,000,000,000 asset class that many fund managers insist belongs in any balanced portfolio.

Changes are coming to capital gains taxes, set to start in January of 2023, that the savvy crypto investor needs to take into consideration in their financial structures.

No more excuses. Join today and don’t be left out in the cold.

Who this course is for

Advanced Crypto traders and early adopters of Bitcoin

| Level | Price | |

|---|---|---|

| MONTHLY PLAN |

$59.95 per Month. Membership expires after 30 Days. |

Select |

| 6 MONTH PLAN |

$129.95 every 6 Months. Membership expires after 180 Days. |

Select |

| LIFTIME MEMBERSHIP |

$199.95 every 12 Months. Membership expires after 365 Days. |

Select |